Maximizing Business Potential: Strategically Utilizing Working Capital Loans

Business growth with a working capital loan is crucial for businesses to operate smoothly and seize new opportunities. It helps cover expenses like buying inventory or meeting payroll when needed. Unlike long-term loans used for big investments that pay off over years, working capital loans provide quick cash for short-term needs.

Businesses often face cash flow challenges, especially during growth phases or seasonal fluctuations. That’s where working capital loans become invaluable. They ensure businesses can manage day-to-day expenses efficiently without interruptions.

For example, businesses can use these loans to purchase inventory before a busy season or to meet payroll obligations during slower months. This flexibility is essential for maintaining operations and seizing growth opportunities as they arise.

Unlike traditional loans that require collateral and detailed financial histories, working capital loans are often easier to obtain. They are designed to be accessible and provide businesses with the liquidity they need to thrive.

Overall, working capital loans act as a financial cushion, allowing businesses to navigate cash flow fluctuations confidently. By securing short-term funds, businesses can focus on their core operations and strategic growth rather than worrying about immediate financial constraints.

Advantages of Working Capital Loans

Effective Cash Flow Strategies

Working capital loans are highly sought-after for effectively managing cash flow in startup businesses. These loans enable timely bill payments, facilitate early payment discounts from suppliers, and help avoid costly late fees or penalties. Moreover, they contribute significantly to revenue streams, a critical aspect in current business scenarios.

Improved cash flow not only aids in maintaining positive relationships with vendors and suppliers by ensuring prompt payments but also ensures a steady supply of essential goods and services crucial for business operations. This financial stability supports sustained business growth and enhances overall operational efficiency. Thus, securing better cash flow through working capital loans plays a pivotal role in the successful management and expansion of startup ventures.

Optimizing Inventory Management and Supply Replenishment

Businesses dependent on inventory or supplies often face fluctuating demand cycles or seasonal variations. Securing a working capital loan offers the essential funding to replenish inventory or purchase raw materials, ensuring uninterrupted supply to meet market demands without depleting cash reserves.

This financial tool proves particularly advantageous for retailers, manufacturers, warehouses, and distribution companies, enabling them to manage inventory levels efficiently and sustain operational continuity. By accessing timely funding, businesses can optimize their supply chain operations, respond promptly to market fluctuations, and maintain competitiveness. Ultimately, leveraging a working capital loan supports business stability, enhances productivity, and fosters growth amidst dynamic market conditions.

Revenue Gap Management

Certain businesses experience a discrepancy between the timing of service delivery or product fulfillment and the receipt of payment. Working capital loans serve as a crucial solution during these periods, bridging the gap and covering essential expenses such as overhead costs while awaiting customer payments.

This financial tool proves invaluable for industries with extended payment cycles, such as construction and consulting, providing much-needed stability and flexibility. By leveraging working capital loans, businesses can navigate through cash flow challenges more effectively, ensuring continuous operations and sustainable growth.

This proactive approach helps businesses manage their financial cycles more efficiently, optimizing overall business performance and resilience in the face of fluctuating revenue streams.

Maximizing Growth Potential

When your business grows, you might need to open another location, hire more staff, or invest in new machinery or technology. These growth opportunities often require immediate working capital. Borrowing from traditional debt sources can strain your existing resources or result in long-term debt.

On the other hand, unexpected events like natural disasters, recessions, or supply chain failures can disrupt your business’s cash flow. In these situations, a working capital loan can serve as a safety net, helping you maintain business continuity during tough economic times. This way, your business can keep running smoothly despite any interruptions.

How to Obtain Working Capital Loans

You can find working capital loans from various sources, including traditional banks, online lenders, and alternative financing providers. When comparing your options, consider factors such as interest rates, repayment terms, and eligibility criteria.

Some lenders offer unsecured loans, but others might require collateral or a personal guarantee. Your business credit and financials will play a significant role in determining what type of loan you can get.

Leveraging Working Capital Loans for Growth and Cash Flow Management

These financing options can help you run your company smoothly in the short term, seize growth opportunities, and ensure your business’s ongoing success.

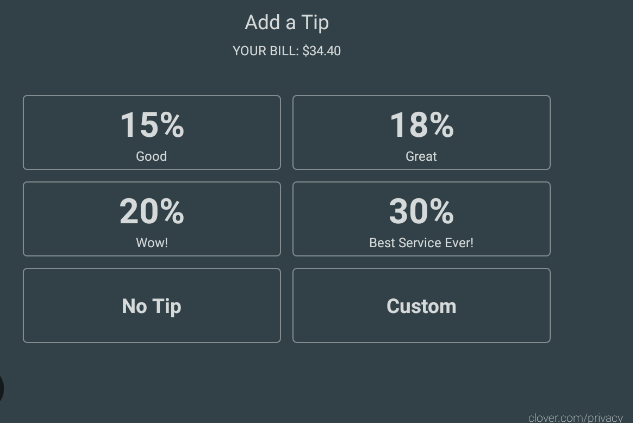

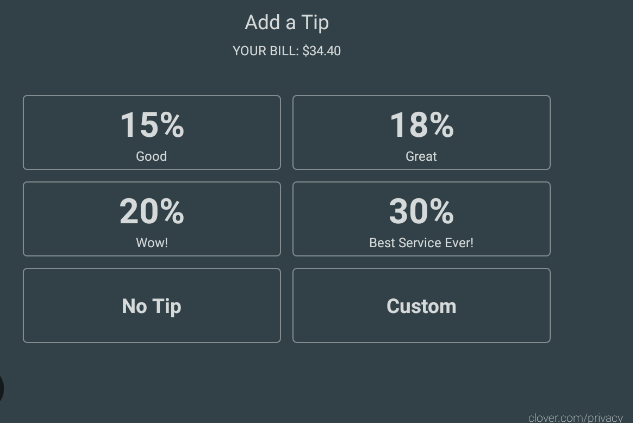

Tip Screen Use: Master the Art with Insider Secrets to Save Time

Rubber Ducky Isopod: Cute and Mysterious Nature’s Hidden Treasure!

Web&Store: Boost Efficiency & Profits with Ultimate Blueprint for Success

Sestil Ad: Essential Uses, Side Effects, Advantages, and Reviews